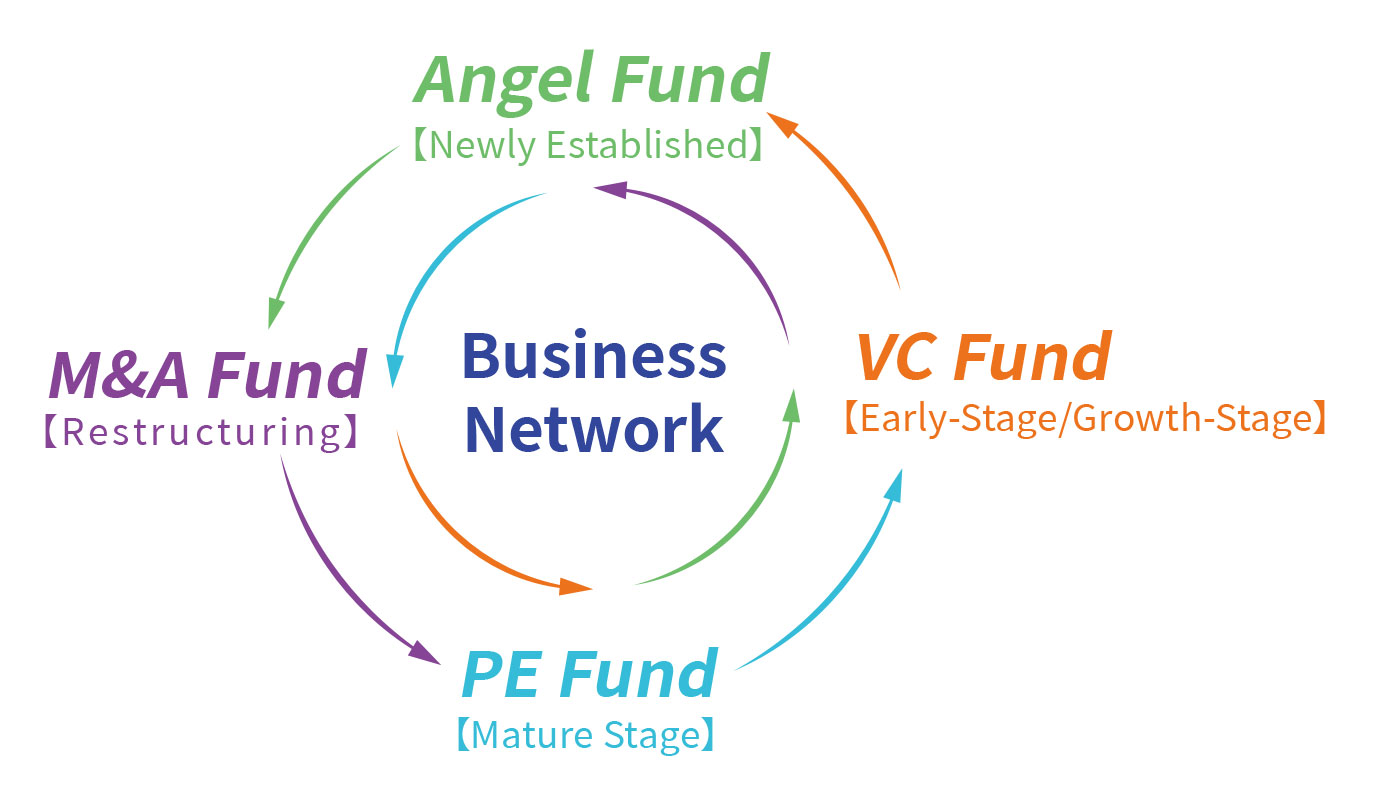

Founded in 2009, Co-win Ventures is an angel and early-stage investor in TMT and Healthcare. We keep nurturing growth-stage companies graduated from our angel investment portfolio and our funds encompass the whole financial product chain, including seed funds, VC funds and PE funds.Co-win Ventures’ business network covers China and USA. We have offices in Suzhou, Nanjing, Shanghai, Beijing, Shenzhen and Hong Kong.

Total AUM size of RMB and USD is about 5 billion yuan. The overall performance of our funds is good, with an average IRR exceeding 40% and accumulated DPI exceeding 1.Our LPs include the Innovation Fund Management Center of the Ministry of Science and Technology, SDIC Chuanghe National Emerging Industry Venture Capital Guiding Fund, Oriza Holding, Xiamen Xiangyu, CRRC Times, as well as local government guiding funds.

To date, around 120 companies have been invested, more than 50% of which are invested in Angel round and more than 25% are in A round. Co-win Ventures is the first institutional investor of most these companies, with the ability to influence them effectively. At present, more than 10 companies have been listed in capital market and more than 10 companies are planned to be listed. Co-win Ventures has full-cycle experience in enterprise management from starting up to successful listing.

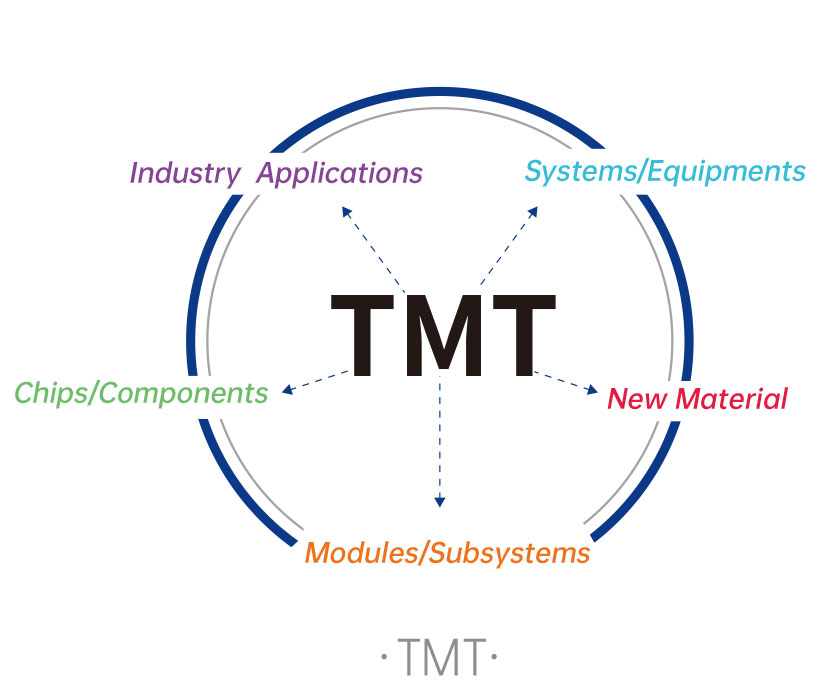

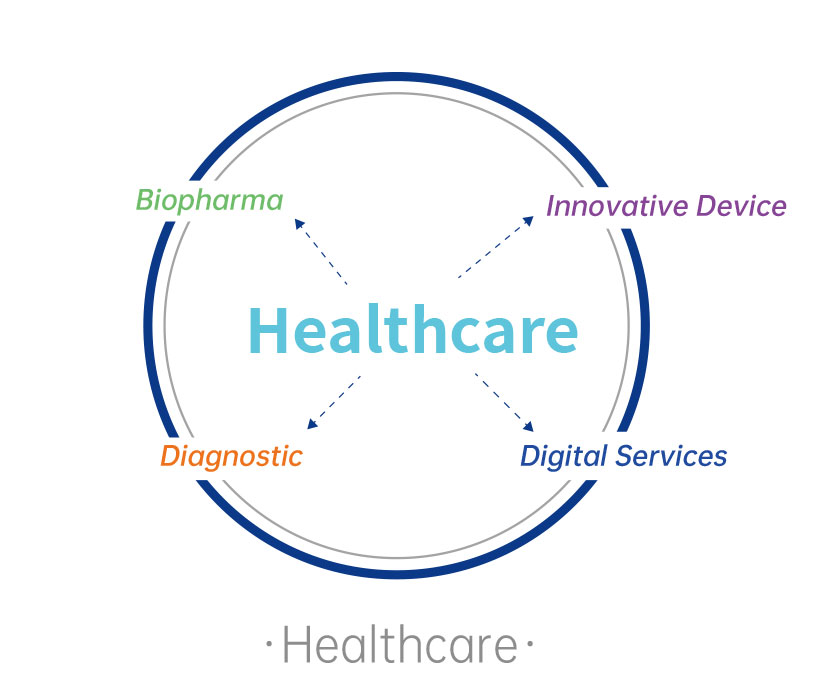

Co-win Ventures invests in the core links of key industries, expands the upstream and downstream of industry chain and emphasizes the industrial synergy between projects. After ten years of accumulation, many companies have stood out in their respective sub-sectors, such as Aucta(biopharmaceutical), Genecast(diagnosis), Cytek(innovative equipment), Thrive(screening), Taimei Medical Technology (medical SaaS service) in healthcare field and InnoLight Technology (communication), Memsensing Microsystems(MEMs), Eastsoft (power) ,New Vision(railway), Aolian Ae&ea(automobile electron) and Sanchao Advanced Materials(new materials) in the field of hard&core technology.

The management team, based on the principle of "driving the overall growth via key investment, emphasizing both value and development", focuses on the related industries and true innovations, expands into upstream and downstream opportunities to build the whole industrial chain. Doing so, we help start-ups quickly set up prototypes, grow the market and build competitiveness and brand name, and finally the significant increase of value. Such investment theme effectively diversifies risk and increases the return.

Co-win Ventures has a sophisticated investment team with strong ability to integrate resources. With rich experience in investment management and in-depth understanding of related industries, we provide comprehensive post-investment management services such as development strategies, product R&D, business development and human resources for our companies, to help them grow rapidly, so as to promote industrial progress and social development.

Co-win Ventures is committed to "become a preferred institutional investor by first-class high-tech entrepreneurs". Our goal is to promote innovation and growth by identifying and cultivating promising start-ups, and to play an active role in promoting industrial progress and social development via co-creation, co-growth and sharing .